Our strategy

Growth capital specialist

in France and Europe

Unigrains invests directly as a minority shareholder in the agri-food and agro-industry sector since 1963.

Unigrains builds partnerships based on an industrial approach, rather than considering purely financial criteria.

Scope of intervention

In the framework of strengthening equity (organic growth and

or acquisitions), and reorganizing shareholder structure (buying minority stakes, asset optimization).

Unit investments between €M 1 and €M 100 in equity and quasi-equity

Possibility of co-investment alongside other partners

Supporting companies of all sizes and in line with the calendar and constraints of their projects

Modalities adapted to the company’s requirements (shares, convertible bonds, subscription warrants)

Long term partner

Mutual approach and strong partnership based on trust to develop an common strategic plan

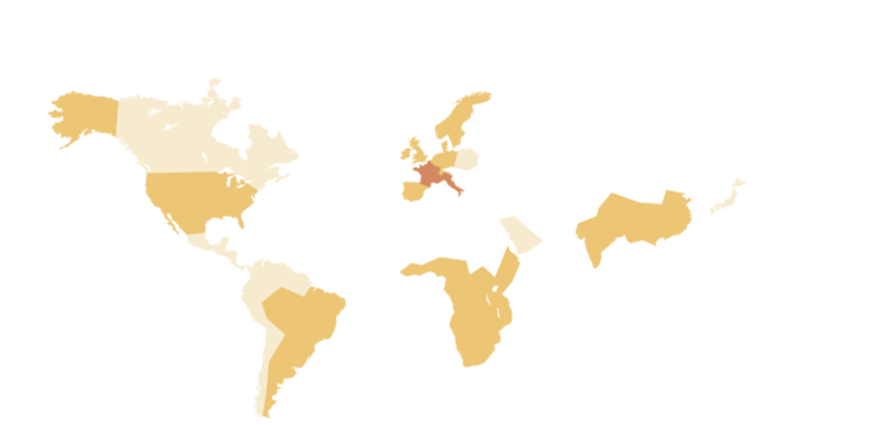

Our direct presence in Europe

More than 1 000 companies supported since 1963.

Six investments already completed

Launch of a Fund open to third parties

Four investments already completed

A network of local partners

An investor in specialized funds

Unigrains invests in private equity funds specialized in agri-food and agro-industry globally. In Europe, Unigrains was at the inception of Céréa Partenaire and is the sponsor of Fondo Agroalimentare Italiano. Through a partnership approach and a rigorous selection of trustworthy teams, the Unigrains partner-funds provide visibility on market trends in complementary geographic zones and can accompany the international development of projects of French partner companies.

Outside of Europe, Unigrains invests in funds specialized in the agri-food and agro-industry sectors in growing regions

Innovation: Identify, support and accompany

the leaders of tomorrow

Unigrains maintains a technological and sectorial watch through investments in venture capital funds, in order to provide our partner companies with the latest in innovation and major trends that will guide the agri-food sector tomorrow.

In 2020, Unigrains joined forces with ARVALIS – Institut du végétal to launch Unilis Agtech : a new financial and technical partner for Agtech entrepreneurs. Unilis aimes to accelerate technical innovation in service of value-creating and resilient agriculture. Endowed with €M 4, Unilis will support a dozen startups. www.unilis.fr

International reach

Unigrains supports its partners in their reflection on international development opportunities. The objective is to contribute to value creation, to develop our sector expertise and to promote the success of cross-border operations.

Unigrains pursues its international development strategy in Europe and around the world by exploring investment opportunities in high-potential geographic areas to support our partners in addressing the major issues facing the agri-food industry tomorrow.

![]() Partner

Partner

![]() Investment/Present

Investment/Present

![]() Teams

Teams